Development Time

7 months

Manpower

10 professionals

Client

An investment and trading company from Wall Street that builds infrastructure for financial markets

Risk officers in trading and clearing companies

The Brief

BriefOur client came to us with a specific and clear request: to develop a system that would show, in real time, the different metrics related to the profit and loss of each clearing house account: realized profit, daily profit, equity of the account.

system ability to react to the market changes in real time

flexible display of information in a variety of ways

This platform must also receive data on all past trades, or if someone has withdrawn or deposited money into an account. This affects the metrics and the system needs to recalculate large amounts of data quickly.

Processing thousands and millions of events in real time, the solution should provide smooth user experience and solid tools for accurate analytics. It must be highly customizable for risk-officers, enabling them to add and set the desired tools that will satisfy their needs and organise dashboards to meet their goals.

Challenges

ChallengesTo develop this system, we had to understand the business issues: how traders and risk managers work, how they analyze information, what options for displaying data will be most relevant. Therefore we studied a lot of additional information about the trading market in order to meet the condition of dashboard flexibility.

It’s also important to understand mathematical models and methods of mathematical analysis to check it in conjunction with the business.

The last challenge was to integrate trading company data with the system. The system has two data sources: the market and the company. It took us a long time to choose a good provider that could quickly deliver data in a convenient format. We were also looking for the right format to integrate data from within the company. The information from both sources needs to be integrated correctly in order to make calculations in the most efficient and fastest way possible. All in all, agreeing on the data format took a lot of time.

Preparations

Preparations

Preparation for the project development was performed on three levels:

Defining the scope of work, role models and key use cases.

Making a list of mathematical models that were planned to be used.

Preparing a product UI concept and conducting the Discovery Phase.

Technologies

TechnologiesServices Provided

ServicesProject management methodologies and standards

Roadmap

Roadmap- Frontend is ready

- Registration process is ready

- Library development by our vendors

- Testing of the platform

- Development start

- Active work with the library and data transfer

- Software release

- Frontend is ready

- Registration process is ready

- Library development by our vendors

- Testing of the platform

- Development start

- Active work with the library and data transfer

- Software release

Key Features

Key FeaturesPlatform user management system

Registration system

A library with formulas and calculations (where the data enters, the library calculates it and sends the result to the platform)

The Results

The ResultsWe have successfully completed the first phase of the project.

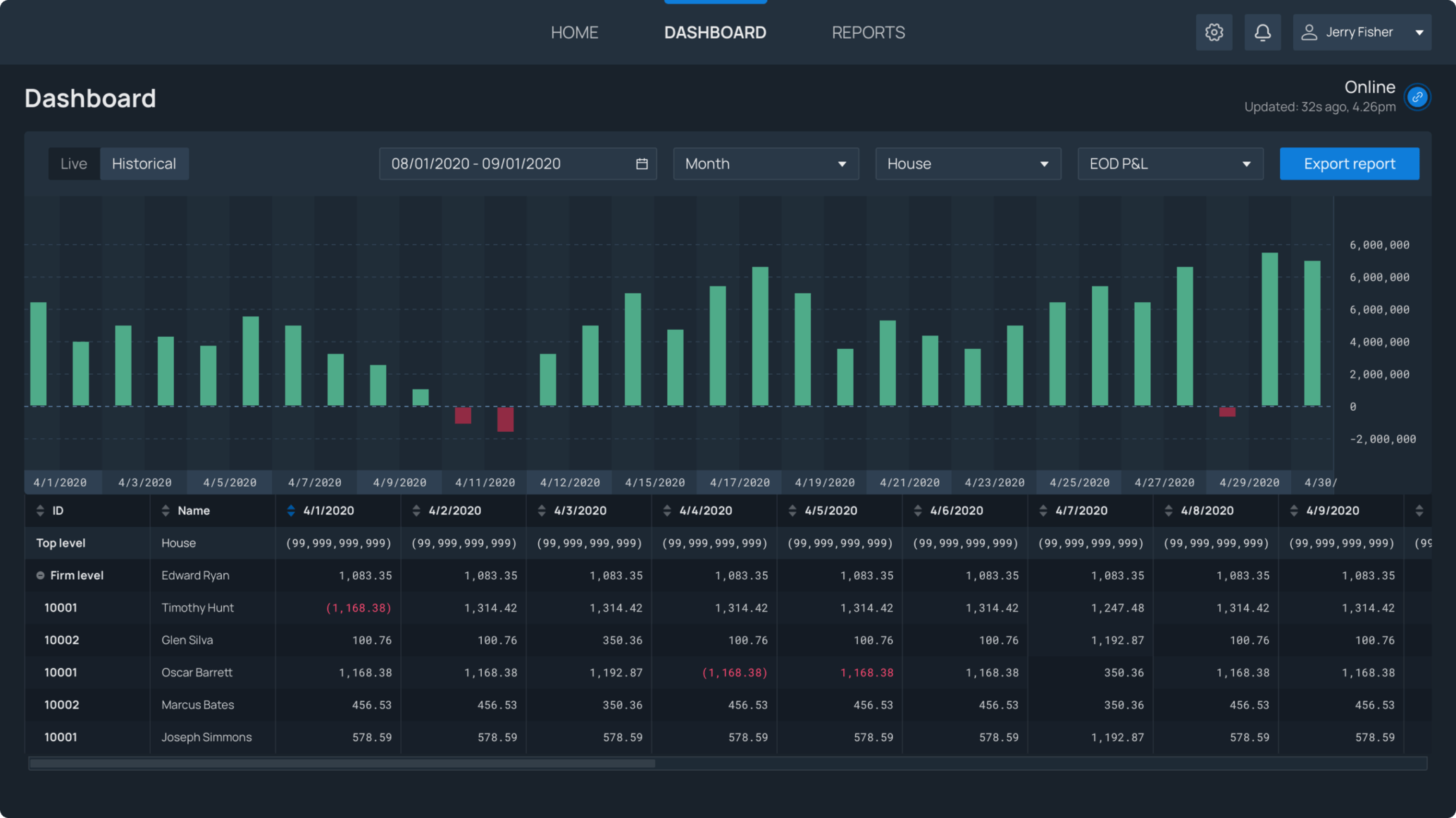

Our сlient received a system that allows flexible monitoring and displaying portfolio risks, taking into account market and company portfolio real-time changes.

Dashboard collects all the information from the trading market simultaneously, and synchronises it with the information about the company’s positions.

The risk-officer can set up visualization by organisation, entity, account position, and get certain professional metrics he wants to see, such as PnL by portfolio and Mark-to-market.

Risk Management platform allows risk-officers to monitor the performance of accounts assigned to them in terms of profitability, complying with margin requirements, risks and other factors in real-time, allowing clearing houses, brokers and dealers to analyze their clients' exposure.

The next phase of the project will involve more complex calculations.

Let's Discuss Your Project

Simply fill out the form or email us at hi@s-pro.io